Since Virginia joined the Regional Greenhouse Gas Initiative (RGGI) compact at the start of 2021, according to data reported by the U.S. Energy Information Agency, the amount of carbon dioxide emitted to provide electricity to customers in the state has grown. Despite two years of RGGI caps and taxes, total CO2 emissions did not shrink, but grew by 3.7 million tons.

That is because the emissions total includes tracking all power producers providing electrons to the state, which is not the same as emissions from power producers located within the state. Virginia’s membership in RGGI is having the exact opposite effect from what its adherents claim it does because, as many predicted, it has forced Virginia to import far more electricity than it used to.

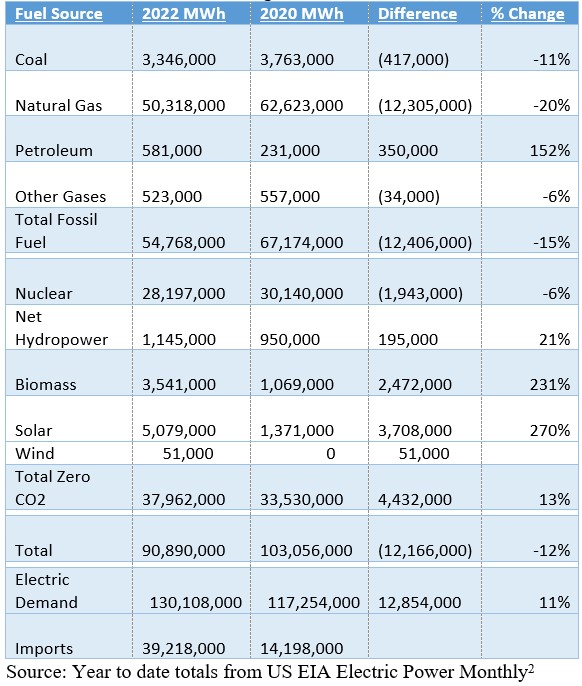

During the two-year period, electricity consumption within the state grew to 130 million megawatt hours, up 11%. Electricity imports grew from 14 million megawatt hours in 2020 to more than 39 million MWH in 2022, up 280%. RGGI has simply driven power production from fossil fuels used by Virginia to other states. As it has for the other RGGI member states.

These conclusions come from EIA data compiled by David Stevenson, director of the Caesar Rodney Institute in Delaware, and long a skeptic on the benefits of RGGI in this region. He added them to the growing list of public comments on the Virginia Air Pollution Control Board’s pending proposal to take Virginia out of RGGI at the end of 2023. More details and citations from Stevenson are contained in a longer discussion which you can read here; and in a table he created, which is reproduced below.

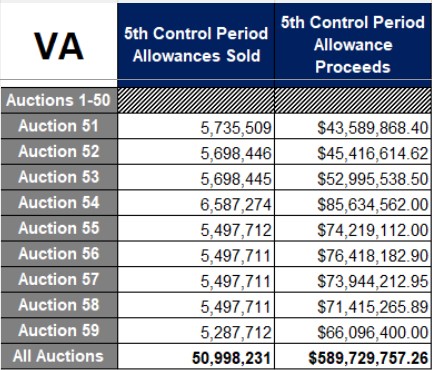

Virginia collected another $66 million last week from electric power producers paying the necessary carbon taxes to use coal and natural gas, bringing the tax total the state has reaped over nine auctions to just under $590 million. The cost of Regional Greenhouse Gas Initiative (RGGI) allowances is usually passed on to electricity purchasers. Dominion Energy Virginia wants to do so directly on your bill.

Stevenson points out that the direct cost of allowances, the carbon tax, is just one of the economic impacts on Virginia’s economy from membership and adherence to RGGI. Within the state’s borders, it is providing a strong disincentive for the production of power. Virginia’s native production of power from fossil fuels dropped 15% over those two years. He applies an average monetary value of the power not produced and estimates generators lost $840 million in revenue.

There is a third economic impact. There are higher transmission costs to cover the process of importing power from the states not covered by RGGI. All these dollars are coming from consumers, one way or another. If and when utility-owned fossil fuel plants are closed ahead of schedule, consumers will also be on the hook for the stranded capital costs.

Solar production inside the state is increasing, and some of the imports are from solar or even wind in other states. But Stevenson’s compilation of the EIA data also shows that burning biomass accounts for much of the growth of supposed “non-CO2” generation during the two years. Many doubt it qualifies for a “green” classification, and in one plant in Virginia it is mixed with coal to get an efficient output.

With power demand on the rise, RGGI will force Virginia to become even more dependent on imports, especially during those periods of low or no production from solar or wind. The whole justification for the new regulatory scheme Dominion Energy Virginia demanded and got in 2007 was to finance a massive program of building in-state generation to reduce dependence on imported power.

That is entirely out the window thanks to RGGI and the even more stringent Virginia Clean Economy Act. The plants built under the buildup are underutilized and in danger of becoming stranded assets and all the while CO2 concentrations in the atmosphere here and around the world are growing, not shrinking.

The economic impact of RGGI on Virginia is just getting started. Should Virginia remain under its edicts, CO2 emissions from the electric power sector within the state will need to shrink another 13 million tons by 2030. To get there, all the remaining coal plants will have to close and electricity production from natural gas would have to reduce by 35 percent, as well. Those would represent a loss of about $1.6 billion in revenue.

The same outcome is dictated by the Virginia Clean Economy Act, meaning RGGI is also redundant. One difference is RGGI includes the tax. VCEA picks consumer pockets by ordering utilities to buy renewable energy certificates when they miss renewable energy goal.

There is another reason to think about 2030, just seven years away. That is the year that another multi-state organization, the PJM regional transmission organization (RTO) predicts serious problems caused by the early retirement of reliable, mostly fossil fueled generators and their (slow) replacement with intermittent wind and solar. A previous article on Bacon’s Rebellion addressed that.

Another interesting footnote goes back to that 2007 legislation. At the time, environmentalists considered it a major victory that the final bill included a legal mandate for Virginia to reduce its electric power consumption by 10% by 2022. We’ve now passed that landmark and the consumption of 130 million MWH instead represents growth of more than 20%. Again, this is the opposite of what advocates intended and promised, the opposite of the General Assembly’s solemn command.

It is like the law of unintended consequences was created to explain the failures and follies of the climate catastrophe movement. Ignore what its adherents say and focus on what they really do. A version of this commentary originally appeared March 13, 2023 in the online Bacon’s Rebellion.

Steve Haner is Senior Fellow with the Thomas Jefferson Institute for Public Policy. He may be reached at steve@thomasjeffersoninst.org.